Power your financial institution’s experience layer

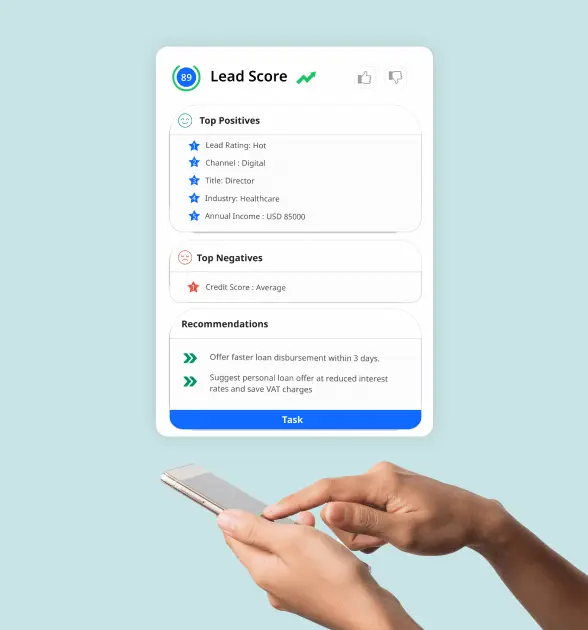

Take advantage of every interaction to advise in customers’ financial moments of truth. Power human and digital experiences with key insights and recommended actions.

Trusted Partnership with

Packaged Solutions for Banks and Credit Unions

Deploy best-in-class and industry specific customer experiences to help your financial institution achieve its mission.

CRMNEXT Recognized as a leader

Insights & Trail Of Success

Boosting loans & deposits: The blueprint for credit unions to maximize CRM data strategy

Data is the key to unlocking a robust member experience. That’s because it enables CUs to learn deeply about members and predict and identify their next best needs. Doing this allows the credit union to demonstrate itself as a partner in their financial journey and conveniently position its products at just the right time. To succeed with data, credit unions need a strategy to bring data together and use it to drive actionable insights. A well-designed data strategy with a CRM can help credit unions unlock significant value.

learn More

Cultivating Leads, Loyalty, and Lifelong Customers with a Bank-Focused CRM

Combined with the right strategy and process, a CRM enables banks and credit unions to connect the dots throughout the entire customer lifecycle. With these insights, banks and credit unions can customize messaging, continually recommend the next best product for the individual, and foster long-term loyalty.

learn More

How to unlock the future: Predicting your members’ behaviors with CRM magic

For too long, credit unions have relied on the idea that knowledge + intuition would predict the future. But it doesn’t. All you get are vague assumptions, like some crystal-ball fortune-teller at a fly-by-night carnival. Sure, they’ll tell you what you want to hear. But you’ll lose money, time, and dignity in the process. To get real answers that retain (and attract) members, deepen relationships, and grow your credit union, you need to add data to the equation. Let’s take a look at these three magic words and how they, along with forward-thinking strategy and process, can make predictions possible for your credit union.

learn Morewhat our cutomers say

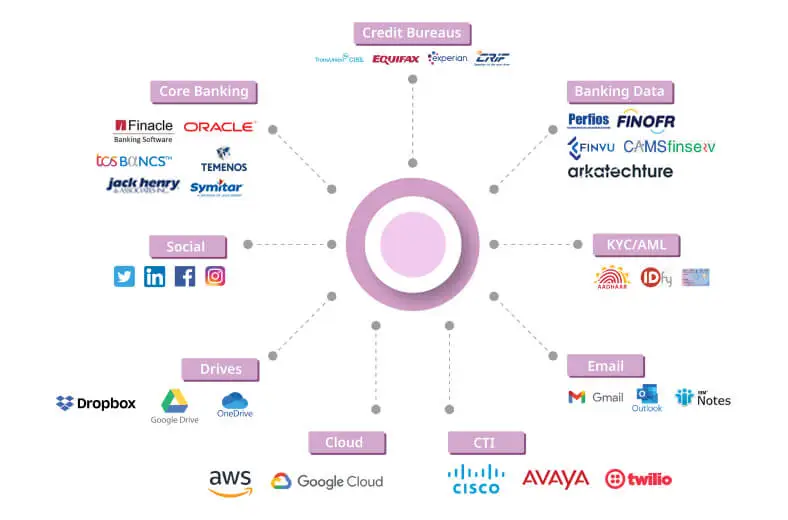

Ecosystem connectoR

UNLIMIT YOUR TRUE POTENTIAL. #UpForTomorrow!

You’re curious and caring, someone excited about solving the hard problems with technology. Fear of the unknown doesn’t hold you back from acquiring new skills to become truly ready for the future and #UpForTomorrow.