Purpose built CRM for Banks and credit unions

Anticipate financial moments with Account Holder’s to meet them where they are.

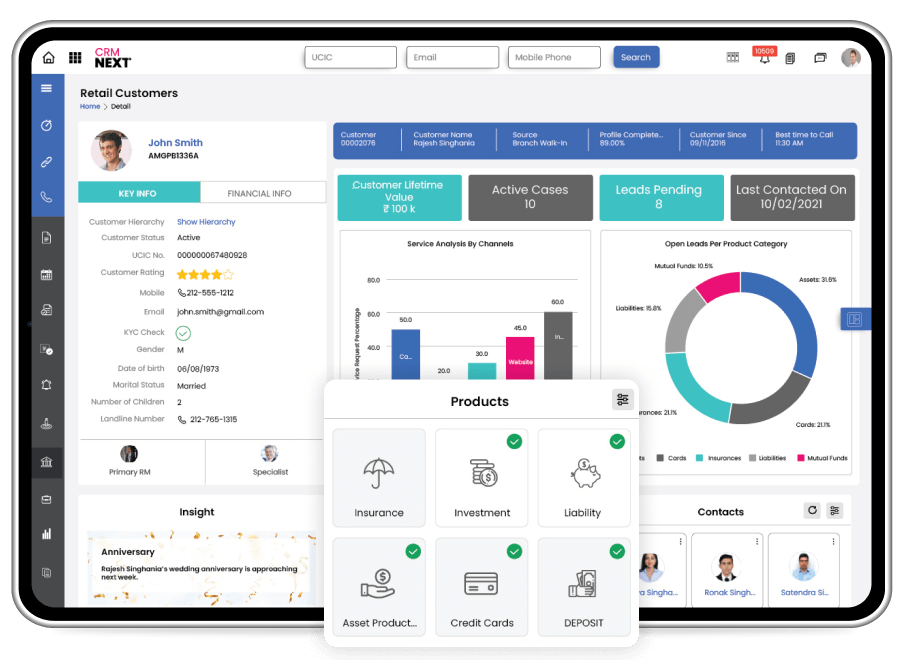

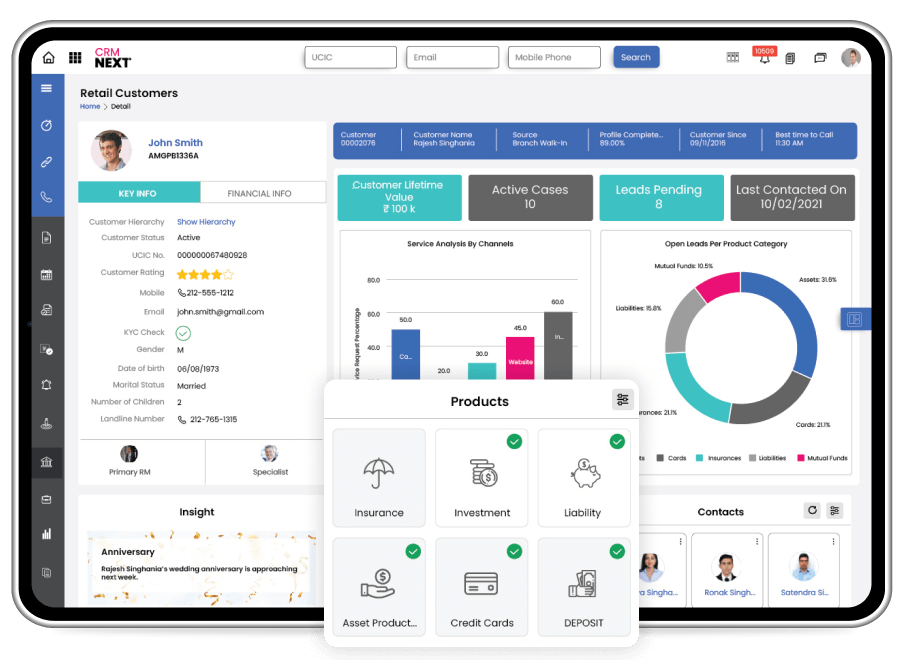

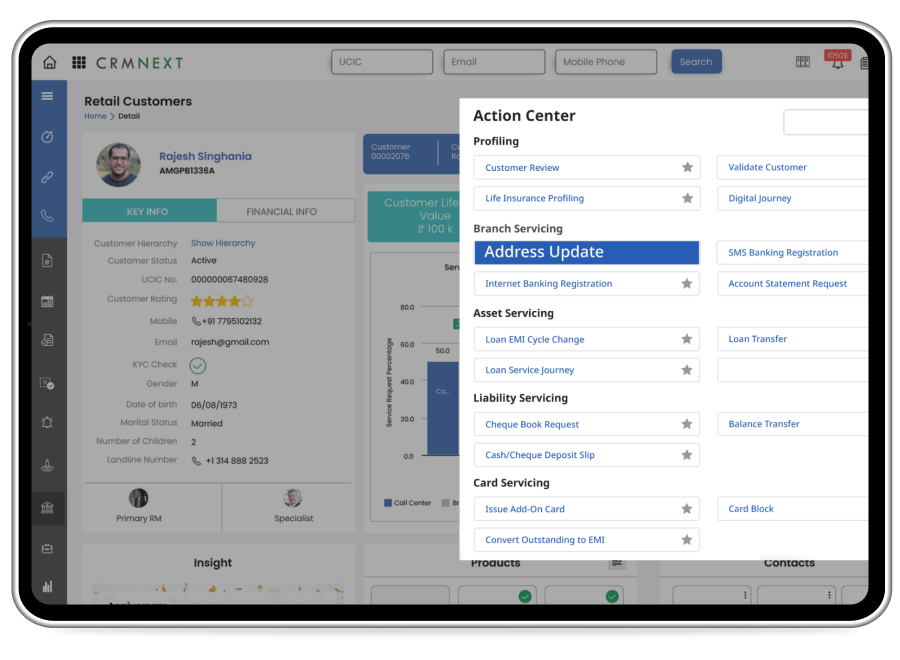

Total Visibility

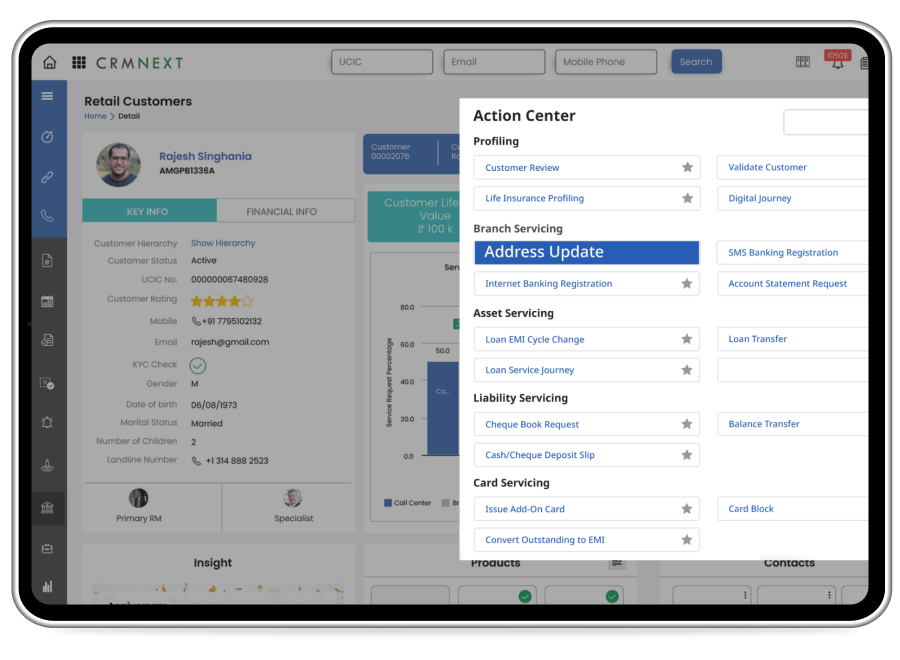

Deliver key insights with a dynamic and complete view of account holders to every customer facing role in your organization.

360 view

Aggregate, unify and organize disparate sources of customer data from your core and critical solutions technology stack to support your account holder’s

every move.

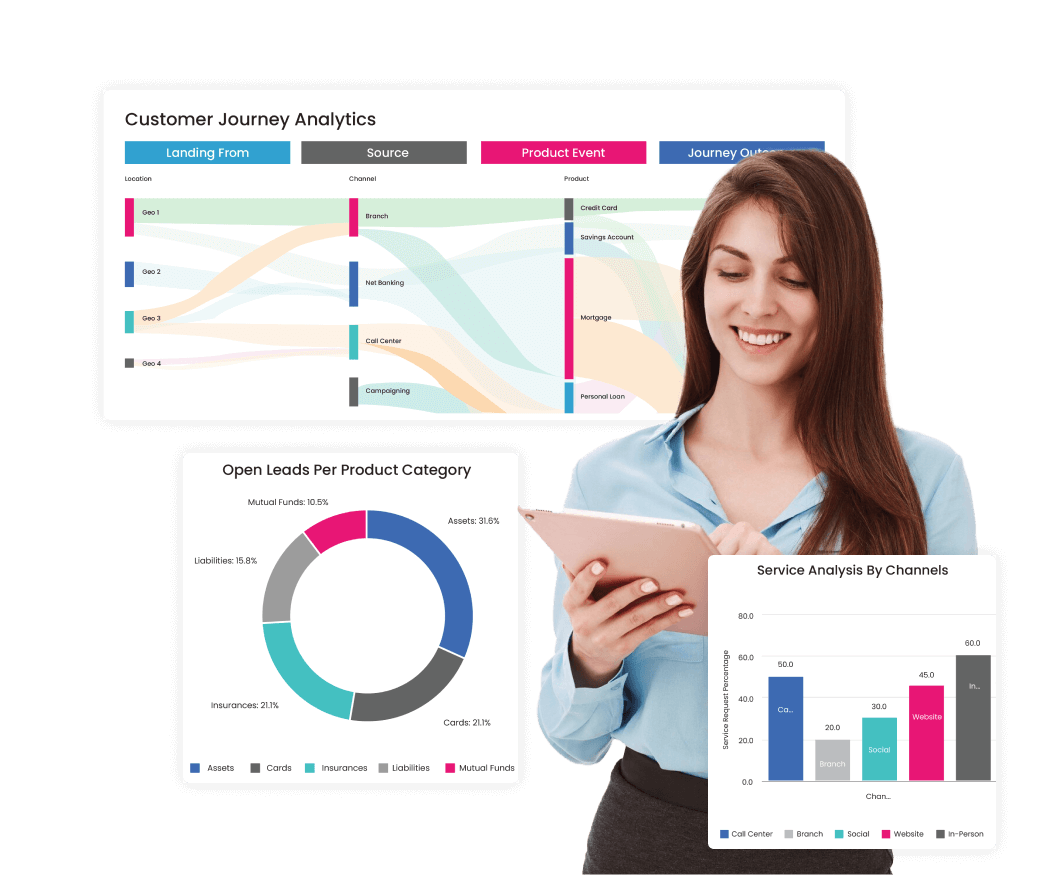

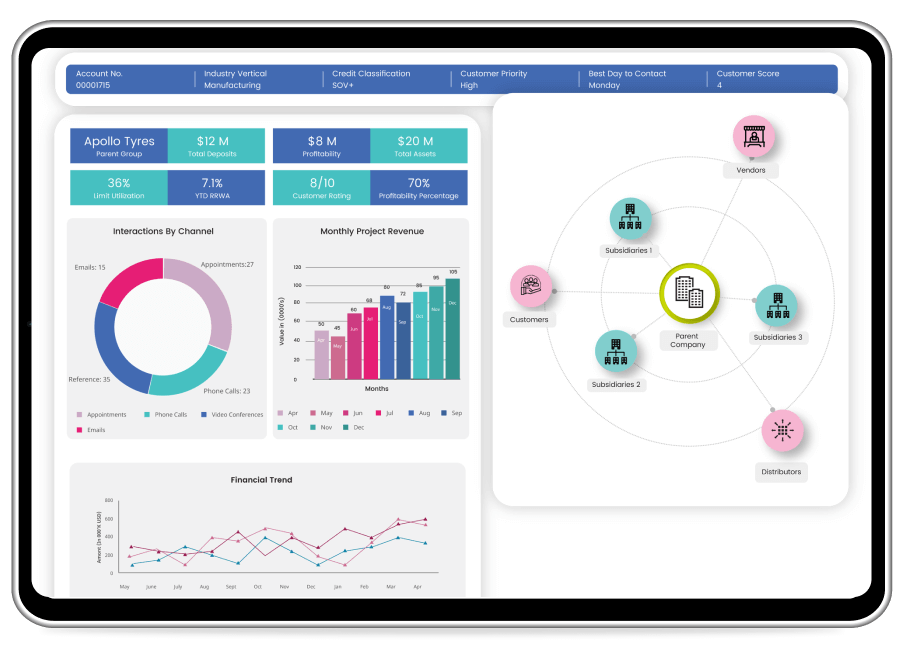

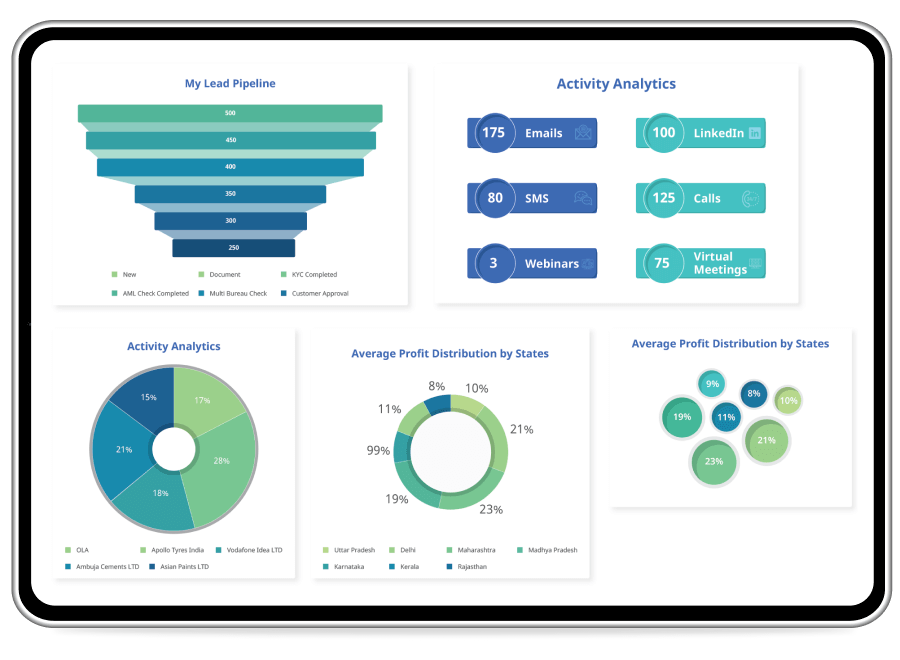

Reporting and Dashboards

Utilize pre-built reports and dashboards or create your own custom reports that map to specific roles in your financial institution. Deliver on your mission by ensuring your

KPI’s are met.

Personalization

Customers require guidance and personal attention as you advise them through financial moments. Make every interaction an experience that supports your mission and operational playbook.

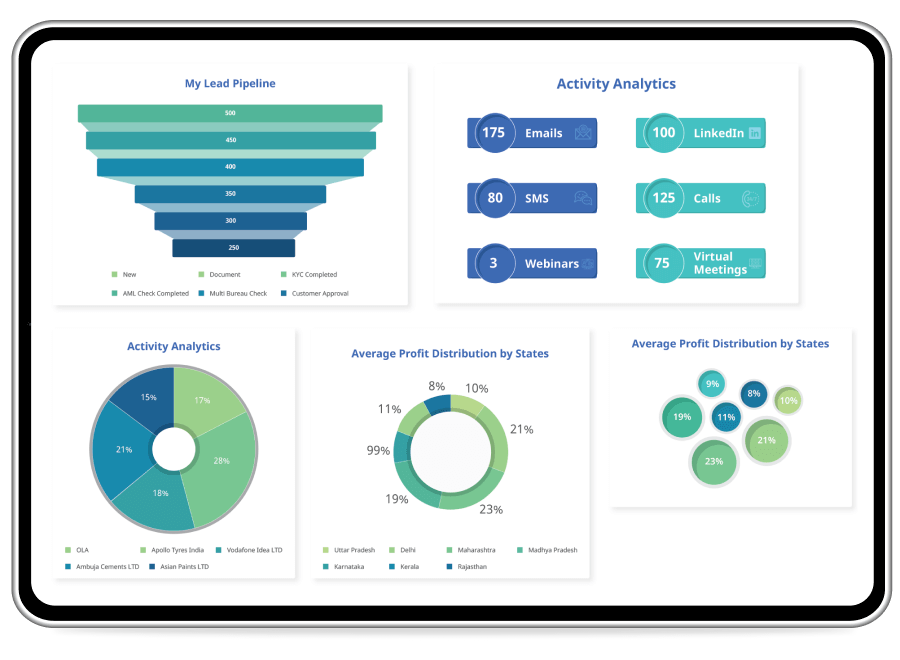

marketing automation

Leverage audience segmentation and simple execution of marketing tactics to extend pre-approved promotions to account holders, at any stage of their journey.

Campaign Management

Track and measure what segments, campaigns, tactics, and offers have performed well. Syndicate and extend marketing strategy to front line teams as an integral piece of executing promotions and offers to your account holders.

Efficiency

Spend more time working with your customers by automating and removing tedious, manual back-end processes. Automate tasks and track SLA’s and ensure you’re achieving operational excellence.

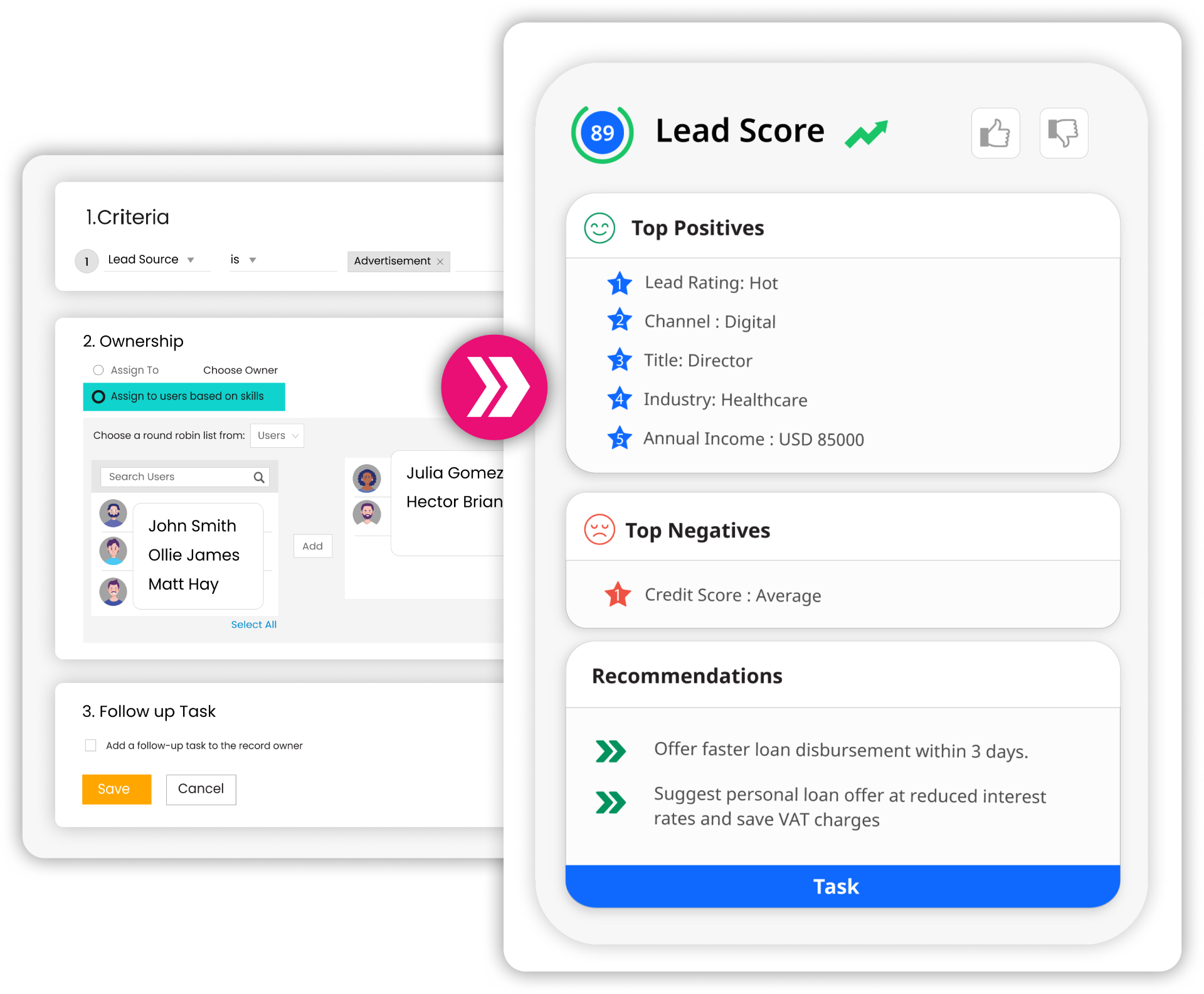

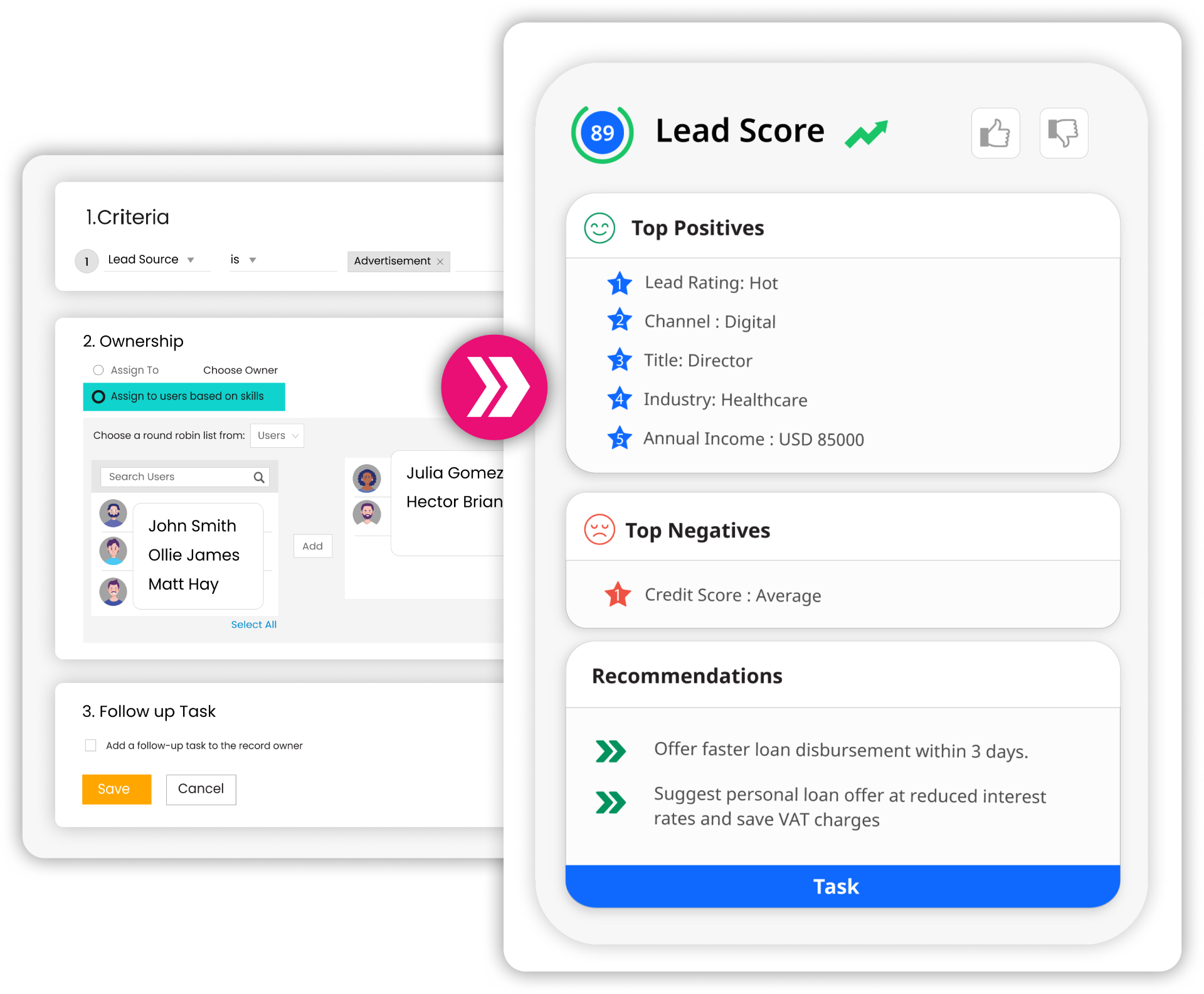

Leads & referals

Quickly respond to opportunities with customers in search of financial products and services. Deliver a unified solution for all teammates to create, assist, and win new growth opportunities. Gain complete visibility into all stages, tasks, and next steps in your opportunity pipeline.

Case management

Drive best-in-class service levels in your organization. Ensure your response times and SLA’s are tracked and compliant. Leave no case unmanaged or unresolved. Grow NPS scores and generate customer referrals to

support growth.

CRMNEXT Recognized as a leader

what our cutomers say

Resources

Boosting loans & deposits: The blueprint for credit unions to maximize CRM data strategy

Data is the key to unlocking a robust member experience. That’s because it enables CUs to learn deeply about members and predict and identify their next best needs. Doing this allows the credit union to demonstrate itself as a partner in their financial journey and conveniently position its products at just the right time. To succeed with data, credit unions need a strategy to bring data together and use it to drive actionable insights. A well-designed data strategy with a CRM can help credit unions unlock significant value.

learn More

Demystifying banking CRMs: 4 critical reasons credit unions need CRM in 2023 and beyond

Today, CRMs are everywhere. They might not stave off an end-of-the-world catastrophe, but they can be used to help your credit union grow and avoid being merged in the process. Just be warned. There’s a big difference between a CRM built for managing sales and marketing versus a true credit union CRM. You need a CRM that does more than store contact information as well as a member’s product and service mix. You need one that helps you avoid a business meltdown and sets you up for success in 2023 and beyond.

learn More

How to unlock the future: Predicting your members’ behaviors with CRM magic

For too long, credit unions have relied on the idea that knowledge + intuition would predict the future. But it doesn’t. All you get are vague assumptions, like some crystal-ball fortune-teller at a fly-by-night carnival. Sure, they’ll tell you what you want to hear. But you’ll lose money, time, and dignity in the process. To get real answers that retain (and attract) members, deepen relationships, and grow your credit union, you need to add data to the equation. Let’s take a look at these three magic words and how they, along with forward-thinking strategy and process, can make predictions possible for your credit union.

learn More