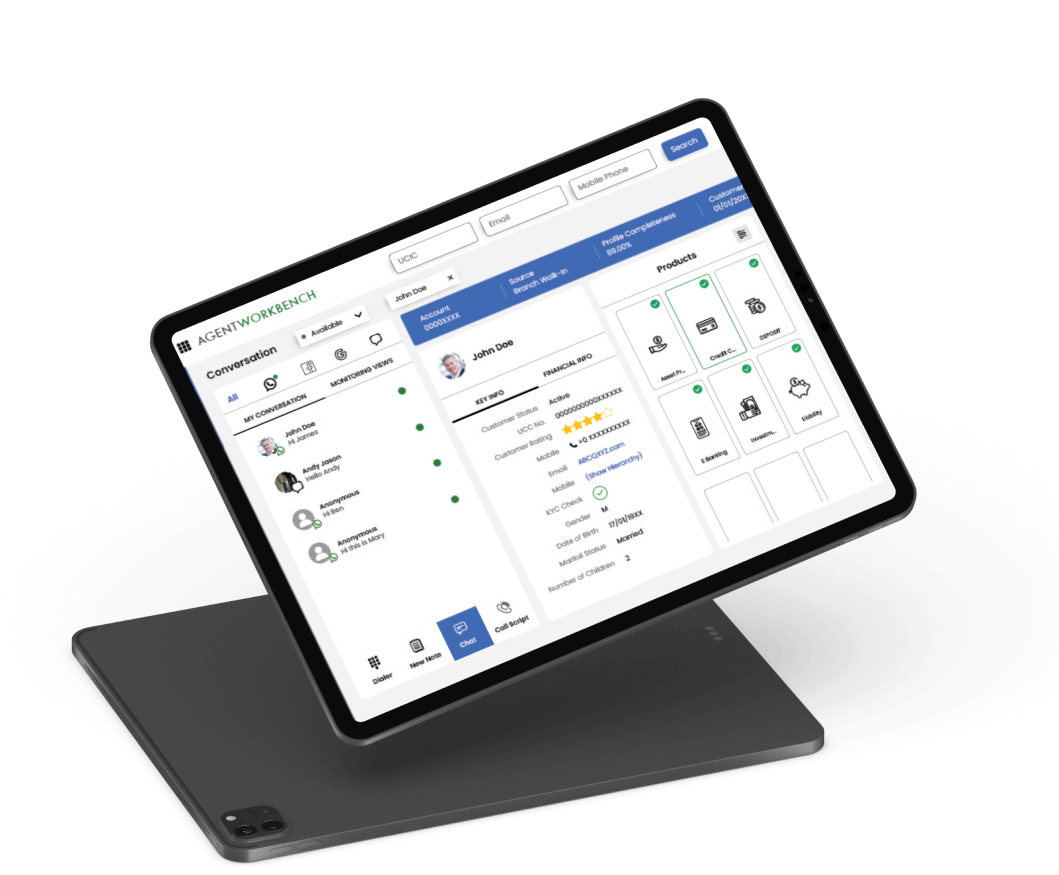

Powerful, digital customer journeys powered by data.

Activate a personalization layer throughout your digital touchpoints to remove friction and reduce manual processes.

increase Conversion

Design comprehensive end-to-end journeys that streamline operations, enhance efficiency, eliminate redundancies, and reduce manual processes.

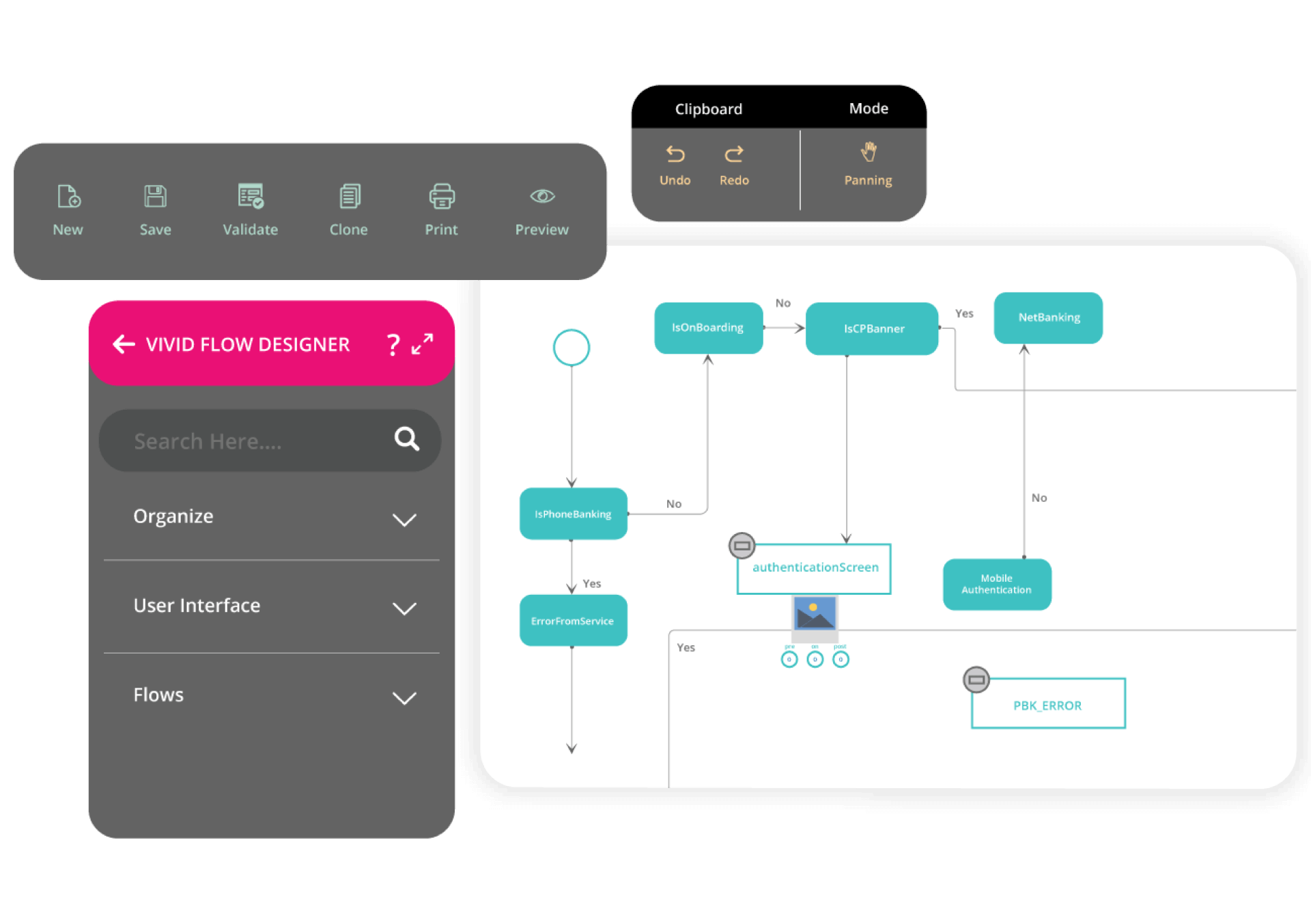

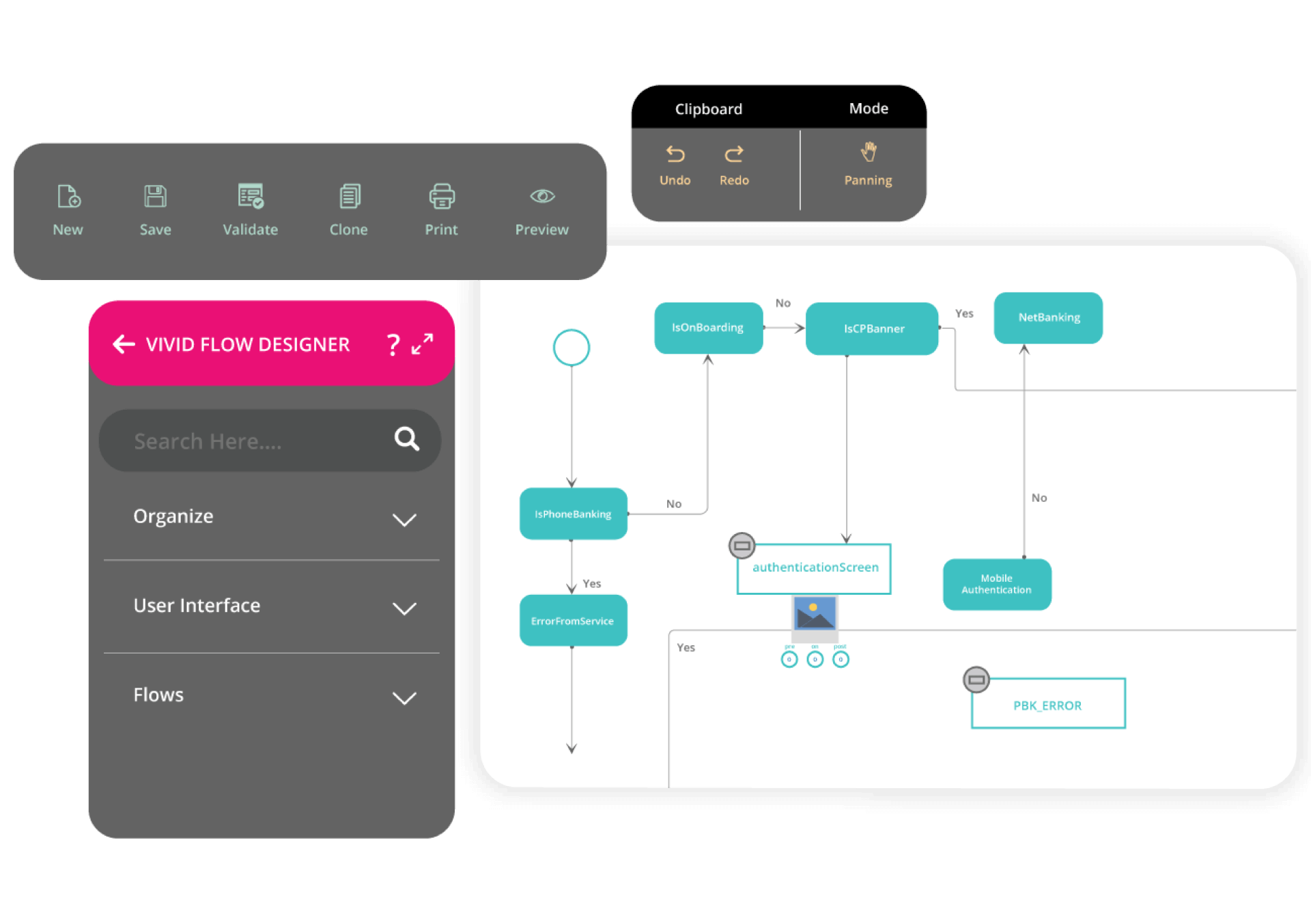

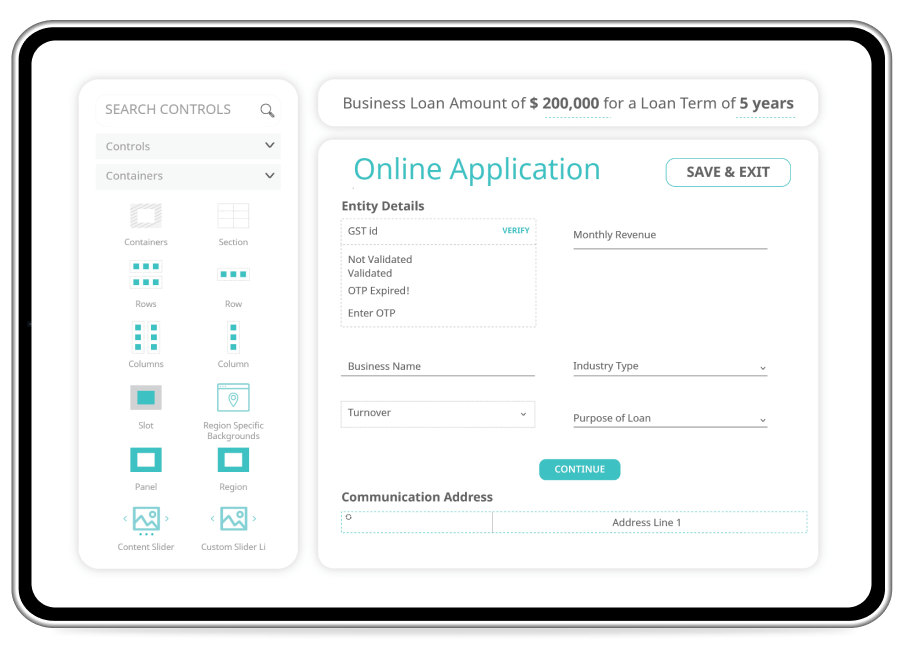

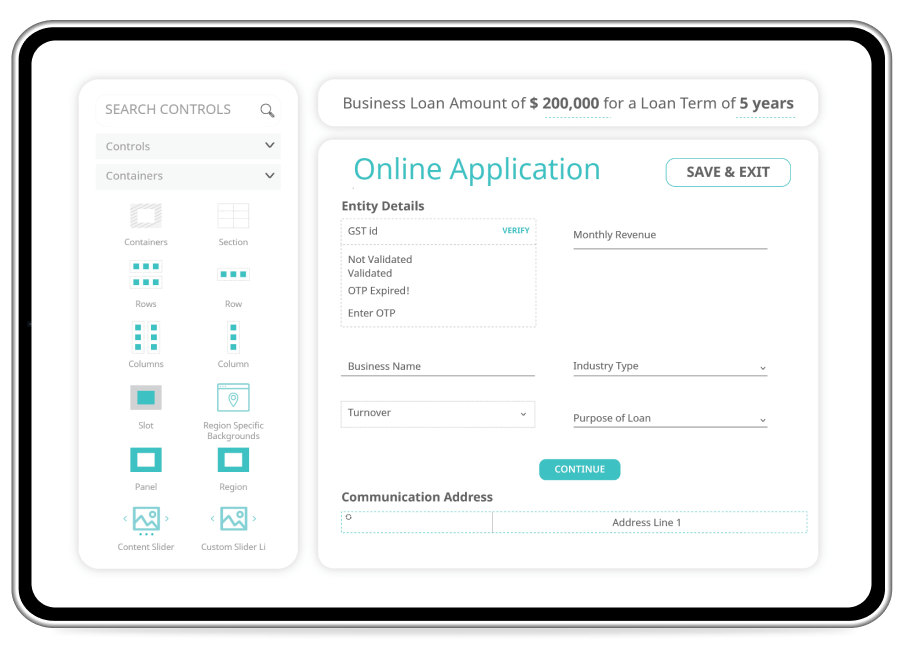

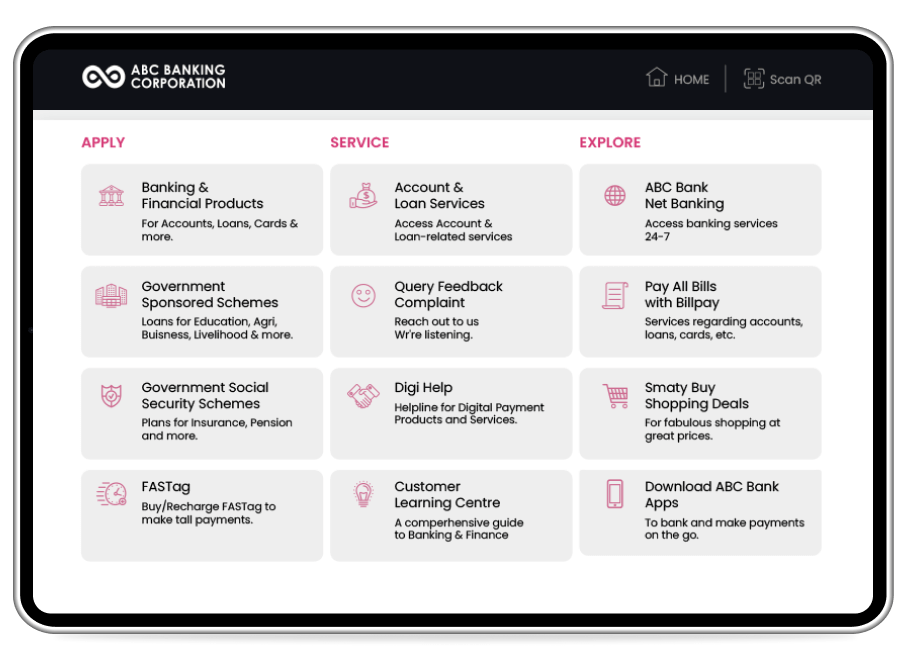

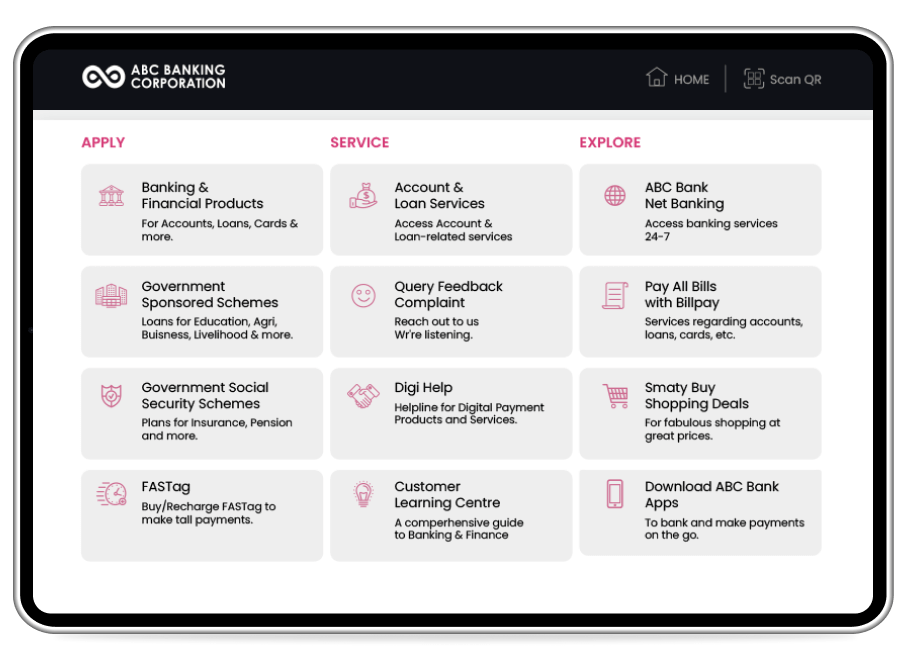

No Code Journey builder

Craft personalized customer journeys effortlessly using drag-and-drop screen navigation and real-time API calls to ensure a seamless experience.

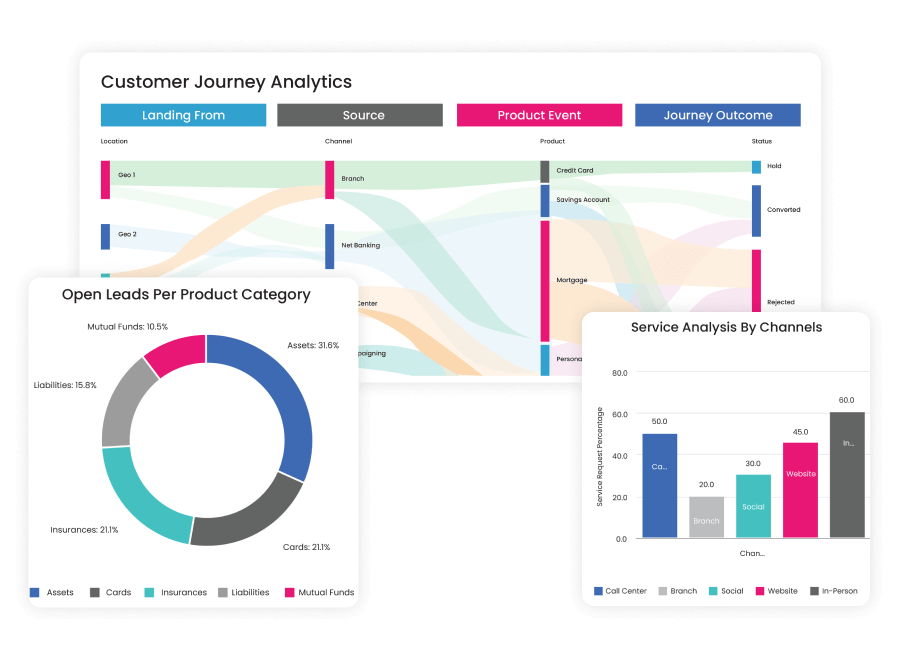

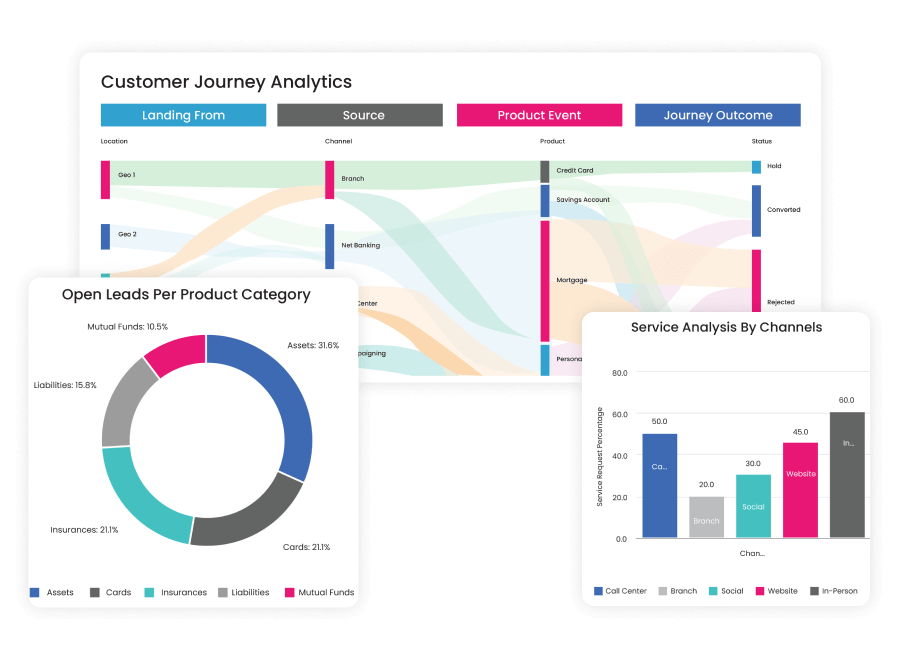

Data & Analytics

By leveraging unified data and gaining insights into your personalization layer, you can ensure consistent and successful digital journeys. Enhance your engagement strategy using real-time data and analytics to effectively power and refine your personalization efforts.

Deploy a personalization Layer

Higher engagement comes from personalized experiences. Develop personalized journeys using embedded decisioning engines and integrating personalization as a core aspect of your growth strategy.

Account Opening

Activate fast account opening journeys that gather appropriate documentation based on ownership and account type. Open accounts successfully and error-free.

Financial Wellness

Optimize wellness journeys for all customers and use cases. Deliver journeys that assist customers with appropriate products and services to help them navigate through a variety of financial situations.

CRMNEXT Recognized as a leader

Insights & Trail Of Success

Boosting loans & deposits: The blueprint for credit unions to maximize CRM data strategy

Data is the key to unlocking a robust member experience. That’s because it enables CUs to learn deeply about members and predict and identify their next best needs. Doing this allows the credit union to demonstrate itself as a partner in their financial journey and conveniently position its products at just the right time. To succeed with data, credit unions need a strategy to bring data together and use it to drive actionable insights. A well-designed data strategy with a CRM can help credit unions unlock significant value.

learn More

How to unlock the future: Predicting your members’ behaviors with CRM magic

For too long, credit unions have relied on the idea that knowledge + intuition would predict the future. But it doesn’t. All you get are vague assumptions, like some crystal-ball fortune-teller at a fly-by-night carnival. Sure, they’ll tell you what you want to hear. But you’ll lose money, time, and dignity in the process. To get real answers that retain (and attract) members, deepen relationships, and grow your credit union, you need to add data to the equation. Let’s take a look at these three magic words and how they, along with forward-thinking strategy and process, can make predictions possible for your credit union.

learn More

How to use CRM to grow and retain membership in an unfriendly economy

Technology, changing consumer behaviors, and growing fintech competition are driving significant changes across the financial services industry. As they fall under increasing pressure to preserve profits and their deposit base, credit unions need new tools and strategies to retain members and add new accounts.

learn More