Purpose built Data platform for Banks and credit unions

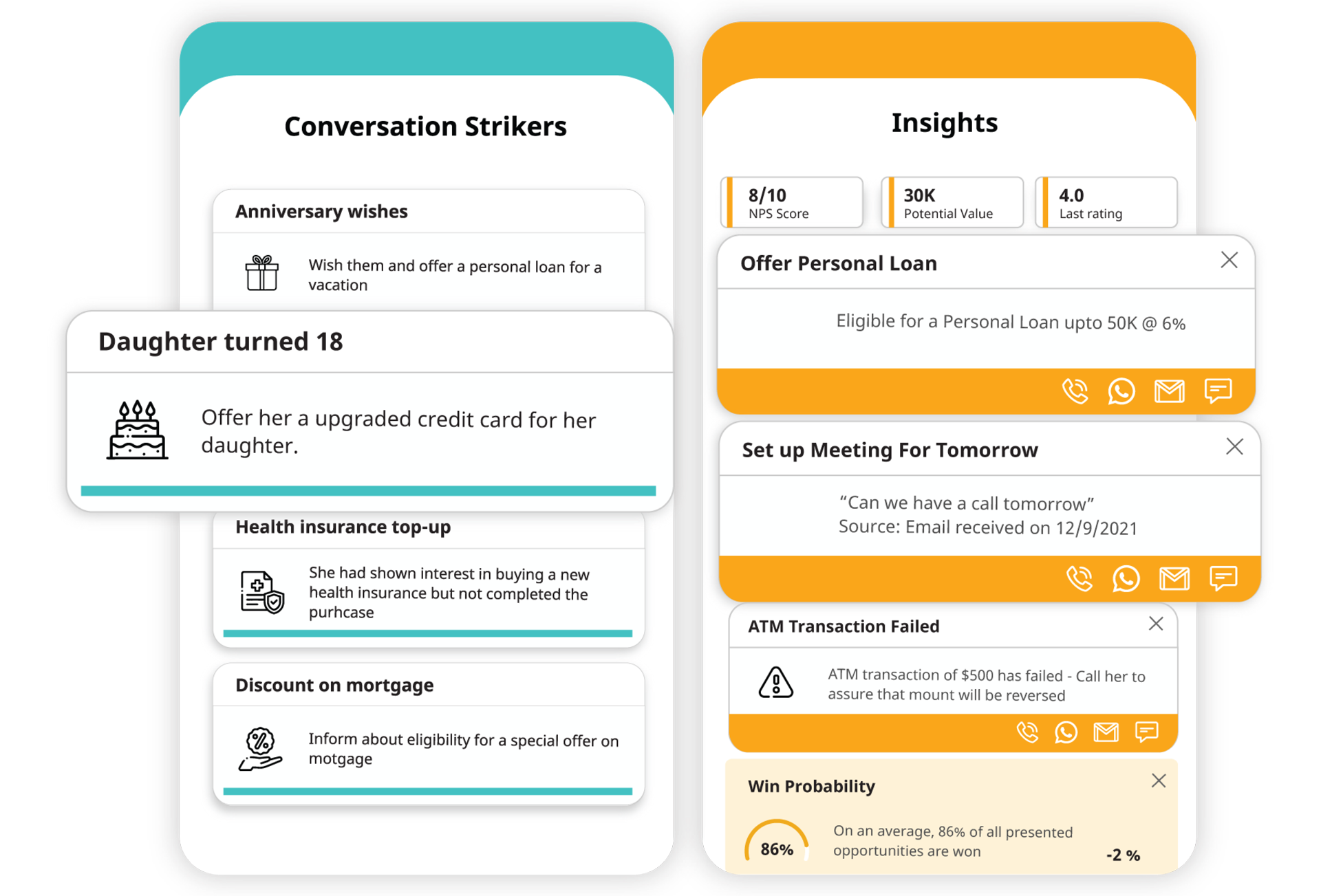

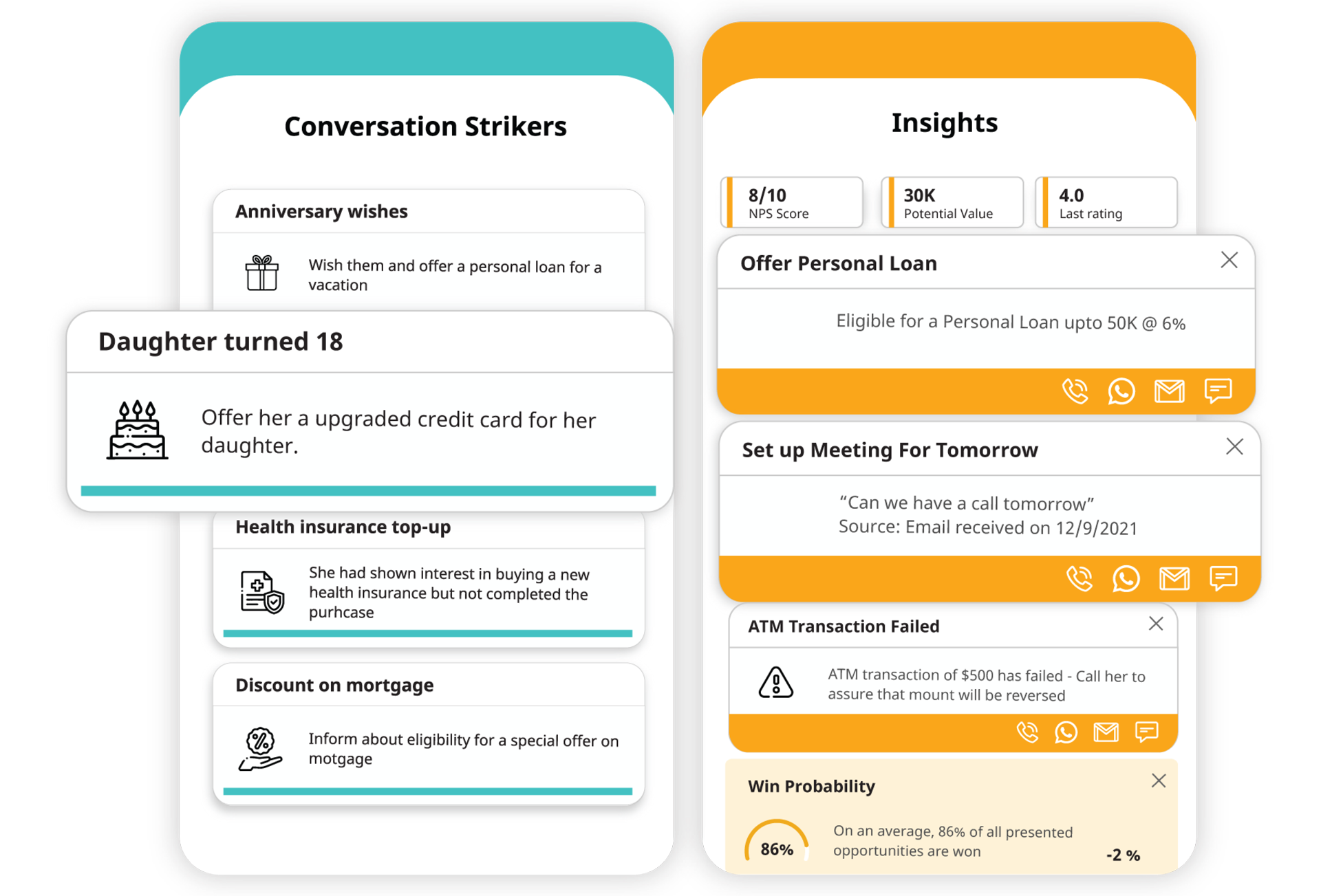

Anticipate financial moments with Account Holder’s to meet them where they are.

Triggers & actions

Data and insights empower your front-line staff to take informed actions and drive personalized experiences in your digital journeys.

Offer Engine

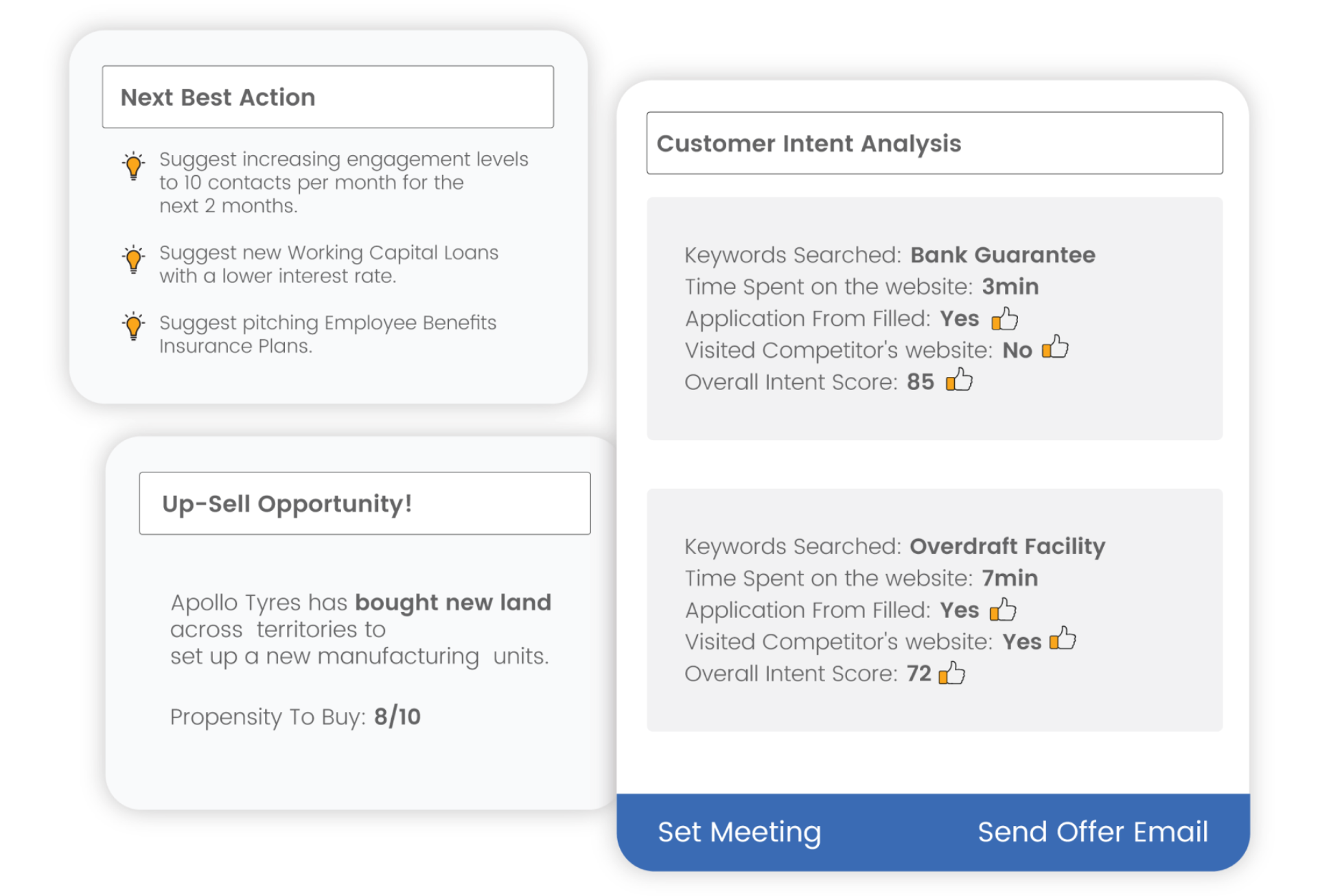

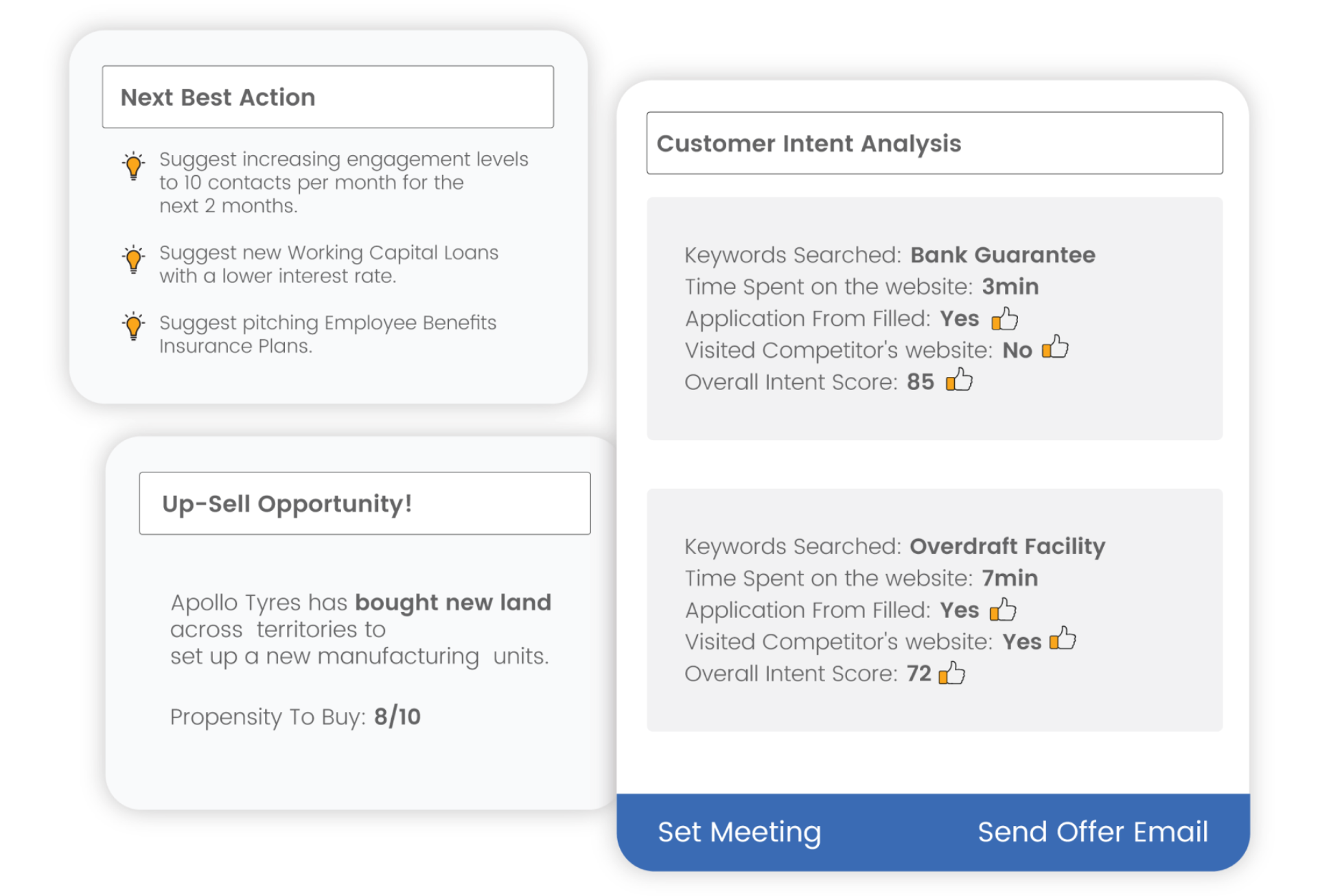

Growth opportunities are all around you. Leverage AI to surface opportunities through transactional data, loan maturity analysis, and general customer behavior to power insights to offers.

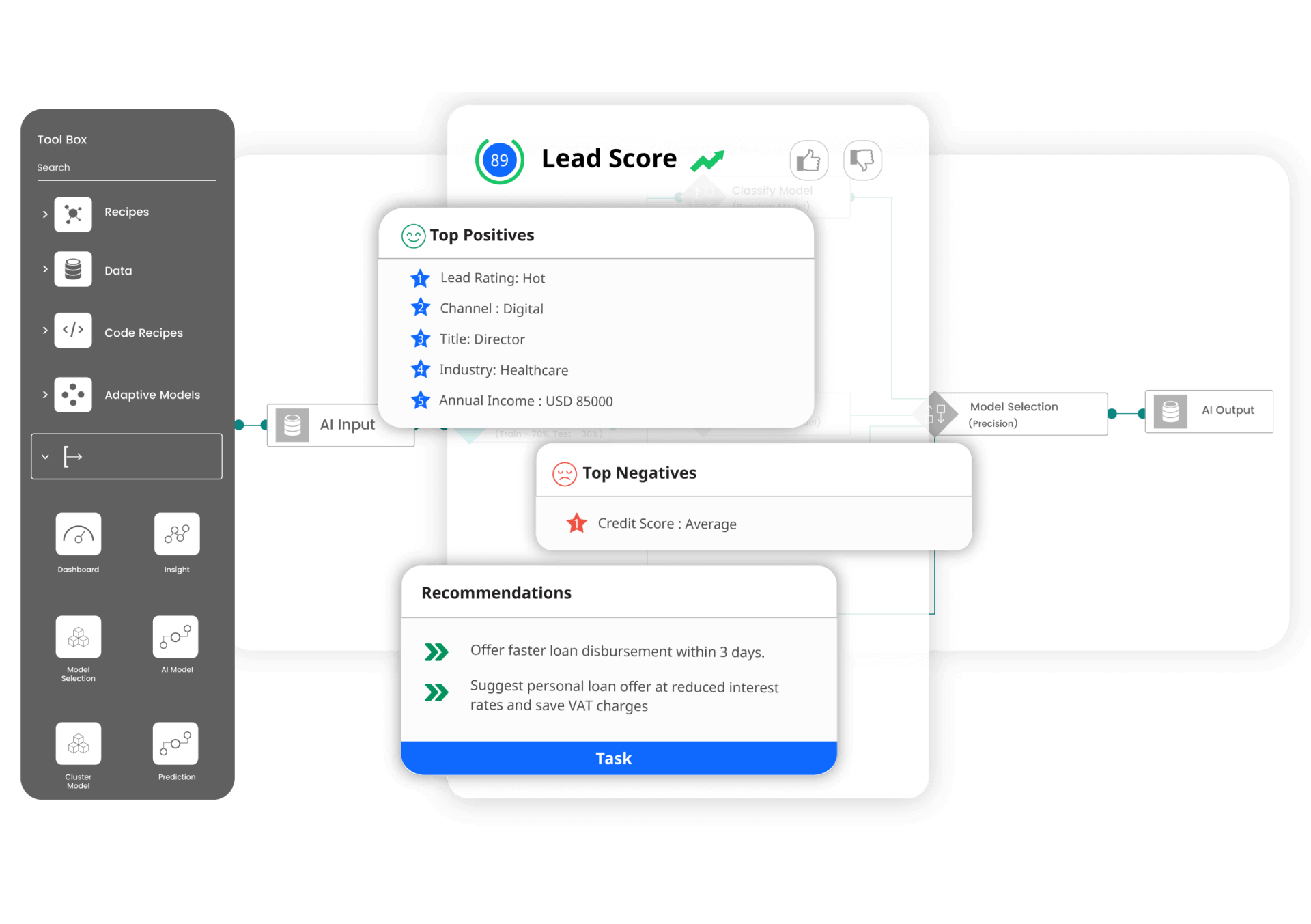

Next Best Actions

DataNext will analyze customer interactions and significant moments to recommend the next best actions, supporting your mission and boosting your margins.

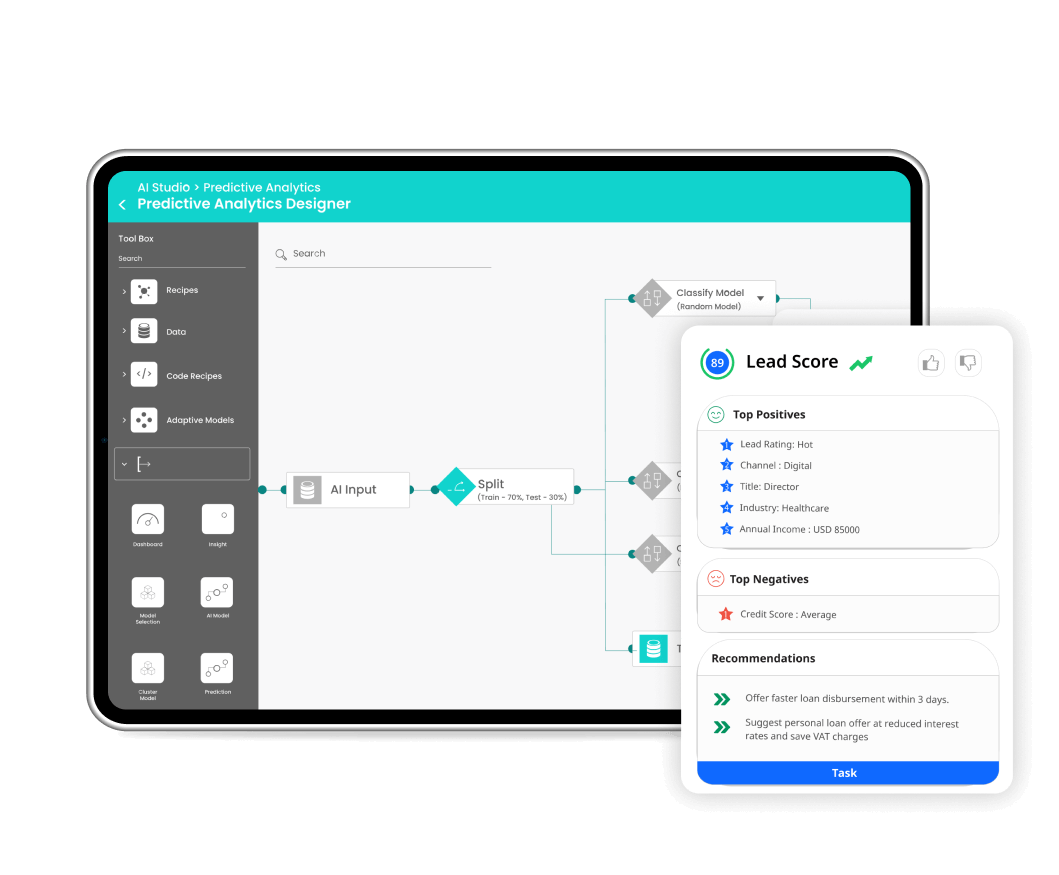

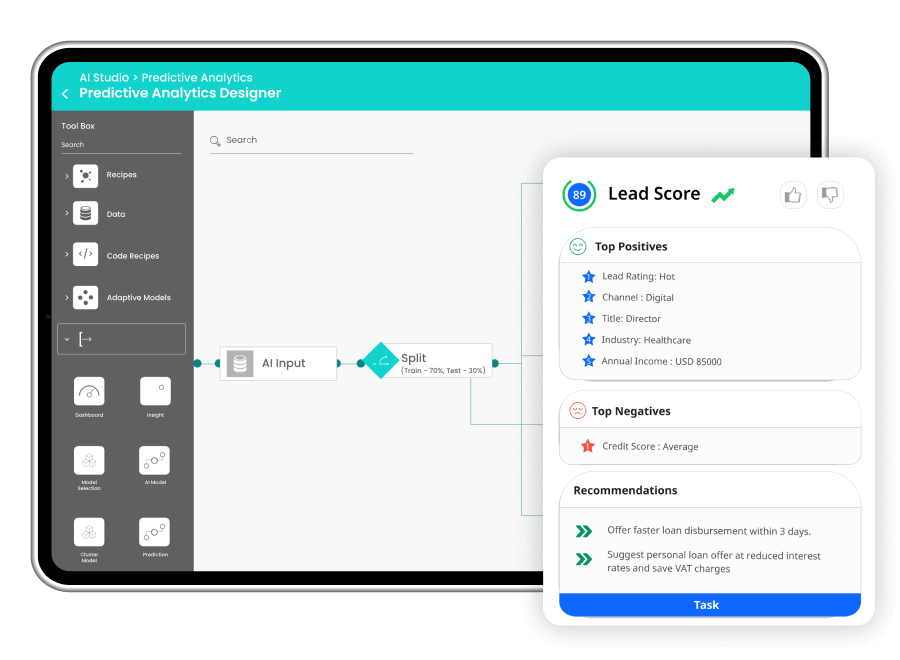

Experience Data & AI Together

Secure your consumer strategy for the future with a potent mix of data and AI, providing your teams with insights through a comprehensive experience layer.

Data Enrichment

Bring the full financial picture of your account holders into focus with a data enrichment strategy. Never miss an opportunity to deepen relationships with relevant products and services for your customers.

Pre-built data models

Leverage trained models that understand transactional data to define persona driven campaigns with dynamic segmentation of your consumer base.

CRMNEXT Recognized as a leader

Insights & Trail Of Success

Boosting loans & deposits: The blueprint for credit unions to maximize CRM data strategy

Data is the key to unlocking a robust member experience. That’s because it enables CUs to learn deeply about members and predict and identify their next best needs. Doing this allows the credit union to demonstrate itself as a partner in their financial journey and conveniently position its products at just the right time. To succeed with data, credit unions need a strategy to bring data together and use it to drive actionable insights. A well-designed data strategy with a CRM can help credit unions unlock significant value.

learn More

Stop hunting for a CRM: Discover the 10 features every credit union should demand

Do you feel like finding the right CRM for your credit union is a never-ending quest, similar to hunting Bigfoot or the Loch Ness monster? You’re not alone. Many credit unions find themselves on a seemingly endless journey. But don’t despair: while Bigfoot and the Loch Ness monster remain myths, the perfect CRM for your credit union is out there. The truth is in this article. If you’re hunting for a real-deal CRM made for credit unions, hang tight! I’m about to unveil the 10 things that a credit union CRM must have before you make your purchase.

learn More

How to unlock the future: Predicting your members’ behaviors with CRM magic

For too long, credit unions have relied on the idea that knowledge + intuition would predict the future. But it doesn’t. All you get are vague assumptions, like some crystal-ball fortune-teller at a fly-by-night carnival. Sure, they’ll tell you what you want to hear. But you’ll lose money, time, and dignity in the process. To get real answers that retain (and attract) members, deepen relationships, and grow your credit union, you need to add data to the equation. Let’s take a look at these three magic words and how they, along with forward-thinking strategy and process, can make predictions possible for your credit union.

learn More